___________________________________________________

Put your child on the path to financial success by teaching good habits around saving, spending, budgeting, and planning for the future. It’s never to early to start teaching and it can be a fun activity for children and parents!

___________________________________________________

Educators:

Play Hit The Road: Manage a fun trip with your friends!

Hit the Road | MyCreditUnion.gov

See below for great online resources to engage kids kindergarten – high school.

(Disable Pop-Up Blockers. Resources will open in a new window)

Grades K-8 Financial Education Resources

Grades K-1 Peter Pigs Money Counter & Cash Puzzler

Grades K – 5 Splash Learn

Grades K-8 Kids Math Games

Middle & High School Financial Education Resources

Can You Afford Your Dream Life?

Movie Producer Budgeting Game

Careers and Money Management

Misadventures in Money Management Game

Ramsey Solutions Budgeting Tools & More

Have Fun Calculating Interest Loan, Investment & Credit Card Calculators

American Southwest Credit Union lists online educational resources as a learning tool for parents and children of all ages. ASCU is not affiliated with the resource sites provided. ASCU does not receive compensation from listed companies or organizations. ASCU does not monitor or endorse any content on these provided website resource pages.

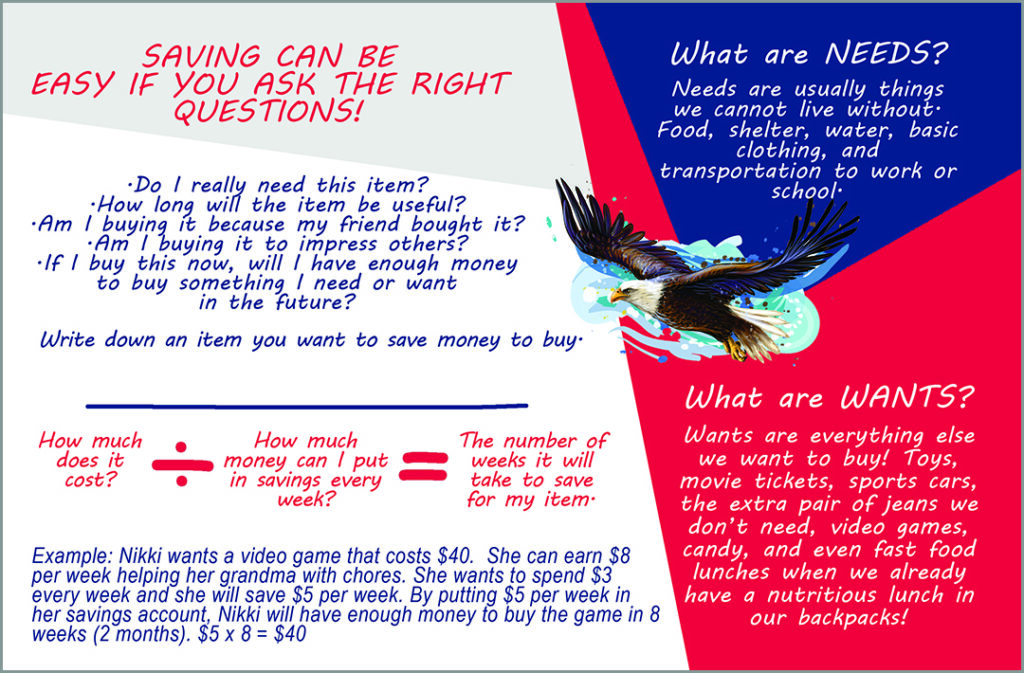

Saving can be easy if you ask yourself the right questions!

Do I really need this item?

How long will the item be useful?

Am I buying it because my friend bought it?

Am I buying it to impress others?

If I buy this now, will I have enough money for the things I need or want in the future?

These questions can help us evaluate if we really need or want and item and if we are buying it for good reasons.

Financial Education for Beginners

Download the PDF packet below: ASCU Financial Education Basics Beginners Resources

Learning to save is like learning to ride a bike. If we teach our kids how to save early in life, they will never forget. Studies show that people who have a handle on saving for long term goals and who are financially responsible are less stressed, have less conflict in marriage and relationships, and have a better, happier outlook on life.

Make saving a family fun activity by including your young children in counting and depositing money into a piggy bank or even a simple box they have colored. Make the activity of saving a weekly goal and a habit by putting the activity on the calendar every single week or even more often for children under six. The piggy bank deposit could be five cents for each child or fifty dollars. Remember it doesn’t matter how much your family deposits into the piggy bank. It only matters that the activity is done regularly and is a fun experience.

Young children should start with small savings goals such as saving enough for a trip to get ice cream or a small treat they enjoy. If the treat costs $4.00, save $8.00. Then when it’s time to leave on your adventure to purchase the treat, help your children count out $4.00 from their piggy bank or box, making sure you point out that you are leaving the rest of the money in there for the future.

Keep saving! With every small item or treat your child would like to save for, save double the amount needed to purchase it. By doing this, you’ll be teaching your children not to spend everything they earn. They will be well on their way toward understanding personal finance, learning the importance of an emergency fund and learning financial self-control.

For older children and teens, help them create longer term goals that are age appropriate. For instance a child of 8 or 9 might set a goal of saving for a larger toy that they want to purchase, while an older teen may set their sights on saving for a first car or a security deposit on an apartment.

Knowledge can change lives and internet research is a teen’s oyster. Don’t be afraid to suggest to your teens that they research financial retirement strategies. Knowing about these strategies early may just change how they spend and save! Then ask them what they’ve learned. Ask them how they see their futures. Saving just a few dollars every month with American Southwest Credit Union, starting very early, can contribute to a financially secure life when your teens are ready to retire. Who knows, you may just have a future millionaire on your hands!

Money and Kids

Teen Finance: Should My Teen have a Checking Account?

October 1, 2023

SHOULD MY TEEN HAVE A CHECKING ACCOUNT? The short answer is YES! About the time they become interested in buying larger items, even as young as 11, 12 or 13, you should consider opening a checking account with your pre-teen or teen. If they do not already have a savings…read more.

Clay Money Toppers for Kids

August 3, 2020

Looking for a fun activity to help encourage your young children to save? Make clay money toppers with your kids for a fun and inexpensive activity. Sculpey Bake & Bend or Craftsmart Oven Bake Clay both work well because you can bake the clay in your regular oven at home.…read more.

Creating Good Savings Habits for our Little Ones

April 2, 2020

Reading is usually a part of an everyday routine with kids. But what about saving as an activity? Saving money is a habit. And developing that habit at an early age is crucial. Here's a quick tip to develop this habit early on. Give each family member a clear jar…read more.

Stuck at Home? Skills for the family to learn

March 23, 2020

While we are spending some unexpected time at home, it can be a time for the whole family to learn money saving skills and to have some extra time for family bonding. I’ve put these ideas together for approximately ages 8-18, but even some younger children are able to learn…read more.

Talking Finances with Teens

January 13, 2020

Have you ever wondered how to teach your kids financial responsibility? How do we prepare our kids to save for the future and to budget, without scaring them with our own problems? Financial independence and living a debt free life is one of the key elements of happiness. Money cannot…read more.

Back-To-School Savings

July 10, 2019

Q: Is there any way to get through the back-to-school season without spending a small fortune? A: Back-to-school time is the second largest shopping season of the year. If all that spending makes your head pound, take heart. American Southwest Credit Union has your back! We'll help you navigate it…read more.